Frustration & Fatalism. A Few Thoughts On Sustainability

In the hope of making this note more readable, a quick summary first while full comments follow.

The sharp rise in global aridity in recent decades tends to get brushed off in the US but climate-driven migration will bring that problem to our doorstep.

There’s palpable sense of frustration and fatalism running through US politics at present. Why? How does the Well-Being of Young Adults Compare to Their Parents’? Not great.

The DOE’s LNG export report has good news and bad news. Good news is the US has enough gas supply to meet both domestic & exports under all scenarios. The bad news is greater exports mean higher domestic gas prices and less energy security as the US is effectively keeping LNG prices down for China even as the Chinese work to strand those US LNG export assets. The remaining concerns feel moot in the current political environment but rising exports will also mean significant increases in GHG emissions as well as negative environmental and community impacts.

However, there is still some good news on low-carbon alternatives developing to limit the need for natural gas – nuclear and geothermal. On nuclear, the question is who is going to succeed - SMRs or traditional nuclear? The answer is probably both but one will hit scale faster and I expect it will be traditional nuclear. A great flag from Andy Lubershane.

As for geothermal, a relatively short note from the IEA on geothermal as a reminder that, despite the relatively nascent state of development, the US is already a global leader and if you want to review the space then this is a helpful spin by Canary Media through the key players while the DOE's Geothermal Power Commercial Liftoff paper from earlier this year is good if you want to dive deeper.

Oh boy. The World’s First Commercial Fusion Plant Will Be in Virginia. A great headline but the press release was the easy part. It’s going to be FOAK, large, is targeting a pretty short timeline (in the early 2030s), will cost billions to develop, and although Dominion is collaborating with Commonwealth they are not committing any capital. This is going to be tough. There’s no perfect comparison but arguably the best is the H2 Green Steel project in Sweden which shows you how it could be done. Triggering Investment in First-of-a-Kind and Early Near-Zero Emissions Industrial Facilities

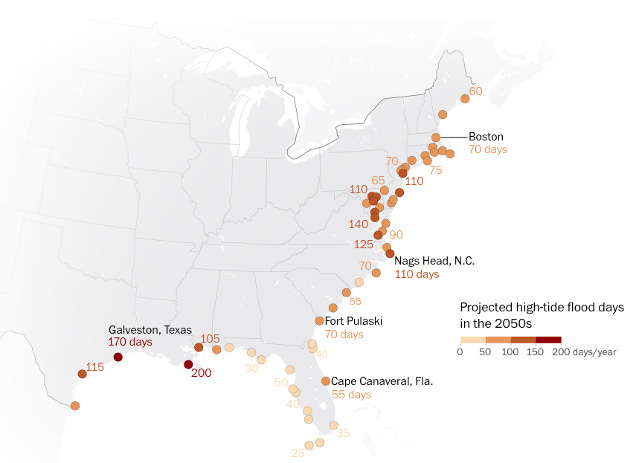

Take a few minutes to scroll through the graphics on sea-level rise on the US Atlantic Coast: The Drowning South. Melting ice, sinking land, and warming oceans are all contributing to overall sea-level rise but it’s the uneven impacts driven by nonintuitive factors that are surprising and leading to many more (50-170) high-tide flood days from Galveston to Boston in the 2050s.

For those of you drifting off into the holidays, some light reading about doomsday… The Hideaway.

_____________________________

There have been quite a few headlines like this recently - An area nearly a third larger than India turned permanently arid in past three decades – and I understand the concern given the research is disconcerting in its own right… Almost 30% of the global land surface is significantly more arid, it has happened mostly in already pretty dry areas, and the main driver – evapotranspiration driven by higher temperatures – means we’re at risk of a feedback loop. Growing aridity poses threats to global land surface. Sardans et al. 2024. “from 1960 to 2023, 27.9% of the global land surface became significantly more arid, while 20.5% became significantly less arid… Accelerated aridification has occurred in already dry regions, such as South-west North-America, North-Brazil, the European-Basin, North-Africa, the Middle-East, the Sahel, and central-Asia, with central-Africa as a new hotspot. The main driver is the disproportionate increase in potential evapotranspiration relative to rainfall, attributed to rising atmospheric temperatures, which also reduces the land’s carbon sink capacity, potentially exacerbating climate warming.”

… but it tends to get ignored in the US because, frankly, the worst of the impacts are felt in Africa. So, worth emphasizing that this eventually ends up on our in the US doorstep regardless courtesy of climate-driven migration… Although Europe will bear the brunt of the aridity-dirven Central African migration in terms of heat the southern Gulf of Mexico region is “already experiencing heat stress conditions approaching the upper limits of labor productivity and human survivability” (see IPCC 6) and – as seen in the figure below – “at the heart of Central America lies the Dry Corridor, spanning across 44% of the land area of Guatemala, Honduras, El Salvador and Nicaragua and is a prominent symbol of the sub-region climate vulnerability…. home to approximately 11.5 million individuals whose livelihoods heavily depend on agriculture and subsistence farming … (while) migration trends between Mexico and the United States, research shows a significant correlation: as crop yields decrease due to climate change, more people tend to migrate from rural Mexico to the US.”

… while those trends in aridity are only just getting started: long term, generally we’re going to see wet areas get wetter and dry areas get drier i.e. the ‘rich get richer and the poor get poorer’ syndrome. Changes in precipitation with climate change. Trenberth 2011.

… and the impact in the US has already been pronounced both in terms of long-term aridity trends and with major recent examples across both the significantly drier west (still in the midst of the second worst megadrought in 800 years) and the much wetter North East (see Vermont) and South (see Asheville).

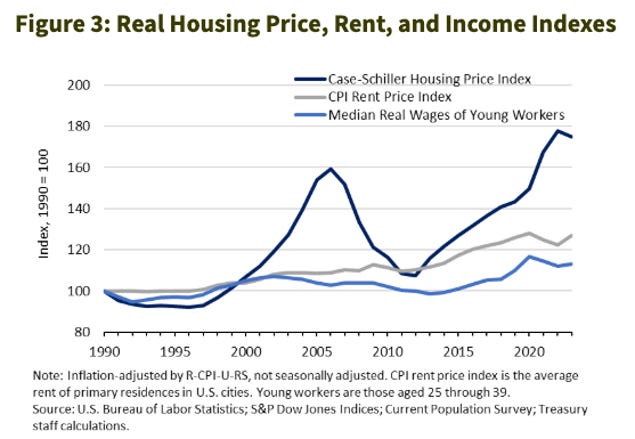

There’s palpable sense of frustration and fatalism running through US politics at present. The drivers are so well-known that they’ve almost faded into the background so it’s worth taking just 3 minutes to spin through this paper from the US Treasury. How does the Well-Being of Young Adults Compare to Their Parents’? There’s definitely been some good things including an overall rise in net wealth of young households and the real earnings of young women but the overall perception of an inter-generational decline in prospects is clearly getting worse especially for young men seen in the decline in real earnings, falling young male labor force participation rates, stagnating young male earnings, rising relative prices of housing & childcare have risen, sharp rises in student debt, all of which is likely leading to a delay in household formation, marriage, and fertility. At the same time, the “health of young adults has deteriorated, as seen in increases in social isolation, obesity, and death rates.” The drivers of those changes don’t appear to be going away any time soon – a large aging population competing with the younger generation for houses and jobs, globalization & technology taking job opportunities, the internet’s impact on social interaction – while the ability to then address those problems is being undermined by the rising costs associated with climate change and an increasingly limited fiscal response as govt debt rises. If you’re not happy about the current tone of politics, well, you’d better get used to it.

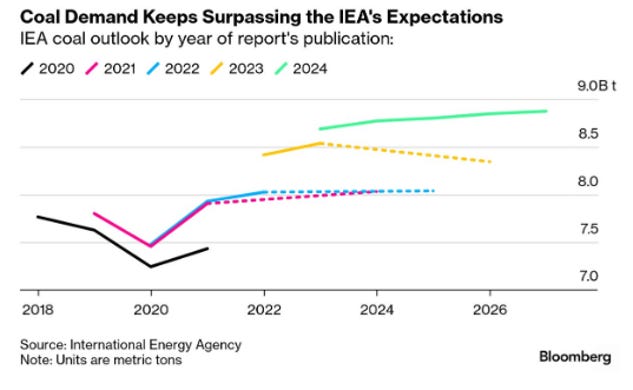

The social license for new coal-fired generation is rapidly disappearing (if not completely gone) in most developed countries with another pointer this week from news that South Korea’s National Pension Service will need to sell some listed equity coal-related holdings…

… but in emerging markets, that’s not the case. That’s why the IEA’s forecasts for global coal product have been revised up in each of the past 4 years and is set to hit fresh record highs each year through 2027 according to their 2024 Coal report. Although the US, EU and RoW continue to bring down their consumption we have China, India and ASEAN going the other way.

If there’s demand for power, it will be met with fossil fuels if low-carbon alternatives aren’t available which is what we’re seeing with US LNG exports (which is arguably as bad as coal)… The DOE’s LNG export report was published this week. As an instrument of policy, it is DOA. However, the content is informative. There’s some good news in that the DOE believes the US has enough gas supply to meet both domestic & exports under all scenarios. However, the bad news is, first, that greater exports means higher domestic gas prices (and likely also higher volatility)… where there’s unconstrained US LNG exports, the DOE expects a “the 2050 Henry Hub natural gas price increases 31% (from $3.53/MMBtu to $4.62/MMBtu, $2022)”. So, what? That’s 25 years away and a 30% swing is the sort of move you’d expect in any single year (for comparison, “Henry Hub prices in 2022 and 2023 were $6.45/MMBtu and $2.53/MMBtu, respectively”). However, the DOE point is a good one especially in the context of rising domestic LNG needs – see AI/datacenters below – and the current authorized levels of exports are already almost half (45%) of US production potentially leading to even greater price volatility. That’s especially in the context of the US politicians being acutely aware of the electoral impact of inflation at present: that 31% increase in gas prices cascades down into 3.4% increase in natural gas and electricity bills for consumers, and a $125bn increase in energy costs for US industry (albeit with a $203bn increase in gross industrial output mostly driven by oil & gas production).

The second big negative is energy security where the US is effectively keeping LNG prices down for China even as the Chinese work to strand those US LNG export assets. No doubt a ramp in US exports has really helped the Europeans in the wake of Ukraine but, on a 2050 time scale, they are moving to decrease reliance on fossil fuels generally. Further, when China is the world’s largest importer of LNG – and I’d also add they’re the world’s largest export of clean tech – it means the US is investing in what will keep down prices for the Chinese who are the same people that are working hard to see those assets becoming stranded by their vigorous investment in (and export of) clean tech.

The remaining concerns raised by the DOE feel moot in the current political environment but worth noting that the US LNG export trajectory will also means significant increases in GHG emissions as well as negative environmental and community impacts. A reminder that, as the Trump administration is set to roll back rules on methane flaring, expanded methane emission reporting requirements, and to pay ‘waste emissions charge’ – then the all-in GHG emissions impact from US LNG exports is arguably higher than coal with upstream/midstream leakage the biggest part of the problem. The greenhouse gas footprint of liquefied natural gas (LNG) exported from the United States. Howarth. 2024.

However, there is still some good news on low-carbon alternatives developing to limit the need for LNG – nuclear and geothermal both of which screen very well in terms of clean, firm, low land use, low transmission build out, local economic benefits and direct heat applications. See Pathways to Commercial Liftoff: Advanced Nuclear

On nuclear, at present, the question is who is going to win? SMRs or traditional nuclear? The answer is probably both… Whether you’re looking at the media to the performance of listed equities, it is clearly front of mind in Trump 2.0. That would seem to create enough space (and investment appetite) for both SMRs and traditional light-water reactors. That’s especially given the history of technology is Darwinian not merely in the sense of the survival of the fittest but also lengthy overlaps between competing solutions (see Origin of Species).

… but one will hit scale faster and I expect it will be traditional nuclear. We’ve already seen the cost & time overruns with the AP1000 Vogtle (7 years behind schedule and more than double original budget) while the appeal of the modularity of SMRs is undermined by the diseconomies of scale driven by regulation especially the approvals process for new designs. However, leaving that for now, if you take the DOE at their word in their Pathways to Commercial Liftoff: Advanced Nuclear, the “first essential step” is to get to a “committed orderbook of 5-10 deployments of at least one reactor design to drive cost declines “based on repeat building and learning by doing”. SMRs look to have the edge given they’re smaller so cost less so any budget overruns are necessarily going to be much smaller in an absolute dollar sense. However, aside from new reactor-type regulatory approvals, the AP1000s have already got a trained workforce in place but, perhaps more importantly, an established global supply chain. A great flag from

Andy Lubershane who “tallied up announcements totaling 26 new AP-1000 units outside of the US, which ought to give Westinghouse and its critical suppliers an even better chance to pull ahead when it comes to deployment cost.”

As for geothermal, a relatively short note from the IEA on geothermal which is nonetheless notable as a reminder that, despite the relatively nascent state of development, the US is a market leader of sorts…. If not in terms of % of electricity production (that’s Iceland 25%, El Salvador 22%, Kenya and the Philippines 17% each, and Costa Rica 13%) but, in terms of the absolute amount the US “produced the most geothermal electricity: 16 603 GWh from an installed capacity of 3 093 MW”. For context, that’s just about 0.4% of US electricity production – feels small but solar crossed that threshold just a decade ago in 2014 (climbing to 0.71% from 0.22% in 2013 – see Our World In Data)

… and if you want to review the space then this helpful spin by Canary Media through the key players while the DOE's Geothermal Power Commercial Liftoff paper from earlier this year reviewing the technology, suitable geographies, workforce, and expectations of cost reductions. In short, we’re already in the process of moving from FOAK to TOAK (Ten-of-a-Kind) driving down costs, and that process is being greatly assisted by a “workforce of over 300,000 that exists today already possesses skills and expertise necessary for geothermal power development… (courtesy of) the oil & gas and electric power industries”.

There’s no shortage of lobbying activity with the incoming Trump administration. It’s impossible to handicap how it all plays out but one line of attack I’m very much rooting for is this one supporting NOAA in the face of Project 2025… In fairness, although Project 2025 does call NOAA an agent “of the climate change alarm industry … and should be broken up and downsized… (it) does not call for the complete dismantling of the NOAA” (see here). Still, it comes at a time when high quality weather data has never been more important and so framing the NOAA’s importance in US vs China geopolitical context can’t hurt (see Trump’s Return Gives China a Shot at Being the Next Weather Superpower). Regardless of the rivalry, a read of China’s President Xi’s comments on weather data - Building a strong meteorological nation serves to ensure high-quality development (press the button top right for an English translation) – reveals a policy stance that would have looked very familiar in Washington DC for decades. A helpful flag from Bill McKibben.

Oh boy. The World’s First Commercial Fusion Plant Will Be in Virginia. A great headline but the press release was the easy part. Yes, fusion is buzzy at present but my reticence to get excited isn’t for fear of jumping on the bandwagon. It’s that it’s going to be FOAK, large, is targeting a pretty short timeline (“in the early 2030s”), “will cost billions to develop”, and although Dominion is collaborating with Commonwealth they are not committing any capital. There’s no perfect comparison but arguably the best is the H2 Green Steel project in Sweden which shows you how this can be done. How? There’s no one-size-fits-all policy suite but they’re going to need a lot of help (and fast) from governments and regulators. Columbia’s Center on Global Energy Policy has a great run-through: Triggering Investment in First-of-a-Kind and Early Near-Zero Emissions Industrial Facilities

Take a few minutes to scroll through the graphics on sea level rise on the US Atlantic Coast: The Drowning South. Melting ice, sinking land, and warming oceans are all contributing to overall sea-level but it’s the uneven impacts driven by nonintuitive factors that are surprising and leading to many more (50-170) high-tide flood days from Galveston to Boston in the 2050s. “Since 2010, the sea level at the Fort Pulaski gauge (near Savannah GA) has risen by more than 7 inches one of the fastest rates in the country”

Never let a good crisis go to waste, the hope is that China’s overwhelming pressure on global auto OEMs will reshape the industry.

Illustrating the rising sense of urgency is two things from the Japanese. The first, extraordinary… “Nissan and Honda are “in exploratory talks about a merger of the two carmakers that would create a $52bn Japanese behemoth…The combined company would rank as the world’s third-largest carmaker behind Toyota and Volkswagen based on last year’s sales volumes, giving it the scale to make investments to compete with Tesla and China’s BYD.” (FT)

(The ex-Nissan boss Carlos Ghosn has described this as a "desperate move". I expect he’s right -and he certainly knows something about auto mergers and the Japanese – but that’s exactly the point. They are desperate and they need to act. Anyway, Carlos is clearly enjoying life more now since he escaped Japan and if you ever wanted the full story behind that, this was a fun read from Vanity Fair: How Carlos Ghosn Escaped Japan, According to the Ex-Green Beret Who Snuck Him Out).

… the second, mundane. The 2025 Toyota bZ4X Just Got A Lot Cheaper. A 13% price cut now puts it in line with a comparably spec’ed Rav4. Why does that matter? Highlights upside from the limited suite of EV products in the US… The bZ4X isn’t a great car but, like the Honda Prologue reminded us, even some OK-ish can be enough given the limited US EV product suite… Toyota have a great brand in the US, strong dealer/service network, and this is their first EV product for the US market which is now coming at a competitive price.

… and because it’s further evidence that, although Toyota got dragged kicking & screaming to EVs, they are finally capitulating into the space. If you want understand how the Japanese got so far behind on EVs, this is a helpful one from Heatmap News: How Did Toyota, Honda, and Nissan Get EVs So Wrong? Quick take is a combination of a lack of natural resources and the Fukushima disaster making the grid dirtier led the Japanese to go for hybrids with smaller batteries & gasoline with potentially hydrogen as the long-term solution.

For those of you drifting off into the holidays, some light reading about doomsday… The Hideaway. “Welcome to the Collapse Laboratory… In an abandoned military barracks in rural Germany, Ben Green prepares for the end of the world… The first thing I noticed was the tiny black-and-white sign hanging lopsided from the metal gate. “PRIVATGRUNDSTÜCK,” it shouted at me. “BETRETEN VERBOTEN!” (“Private property, entry forbidden!”) The gate was unlocked. I watched from the car’s back seat as the wall of faded camouflage netting yielded. Nervous, I reached for my phone. No service. Two long, tall barracks came into view, mirror images of each other. The severe silhouettes, matching blocks of Soviet Lego, were softened by shades of lush green all around. I stepped out of the car and inhaled the sharp scent of fresh pine. Golden hour was approaching, and I could hear the cicadas tuning their instruments. Two women wearing wide-brimmed hats and gardening gloves looked up and waved. As the sun grazed the treetops against a cotton candy sky, I thought that if this was a doomsday survivalist’s paradise, it seemed more paradise than doomsday.”